Mid-caps: A Sweet Spot for Sustainable Investing

INTRODUCTION

Often misunderstood or overlooked, mid-capitalisation (“mid-cap”) stocks can offer investors attractive characteristics and risk-adjusted returns compared to their small and large-cap counterparts. Many investors look to small or large-cap stocks for their portfolio allocations, not considering mid-cap as ‘sellable’ or regarding it as sitting in the middle and not worth the same consideration. We believe the opposite is true, and that in fact, investors’ lesser interest in mid-caps results in more attractive, under-researched investment opportunities. Having overcome the growing pains of small firms, while having room for growth and expansion, mid-caps are the best potential pool of companies that could indeed be tomorrow’s leaders.

In this paper, we will outline why we believe mid-cap stocks should be on every investor’s radar. Further, with the greater prominence of sustainable investing, we outline why mid-cap stocks by nature exhibit positive ESG characteristics and how despite this, investors often crowd within the large-cap space in their search for sustainable stocks.

WHY INVEST IN MID-CAPS?

WHAT ARE MID-CAPS?

There is no universal definition of a mid-cap stock. Depending on who you ask, it may be a stock with market capitalization from $1-10bn, $0.5-25bn or anything in between. The S&P 400 index, the mid-cap index beneath the better-known S&P 500index, tries to capture stocks within the85th-93rd percentile of all available US stocks. The constituents of the MSCI World Mid Cap Index range between $1.5bn and$38bn at time of writing. ‘Mid-cap’ is thus a relative term and will imply different ranges in different regions and industries. Broadly speaking, mid-caps sit somewhere beneath the largest businesses in the world and above the smallest.

WHY NOT JUST INVEST IN LARGE OR SMALL-CAPS?

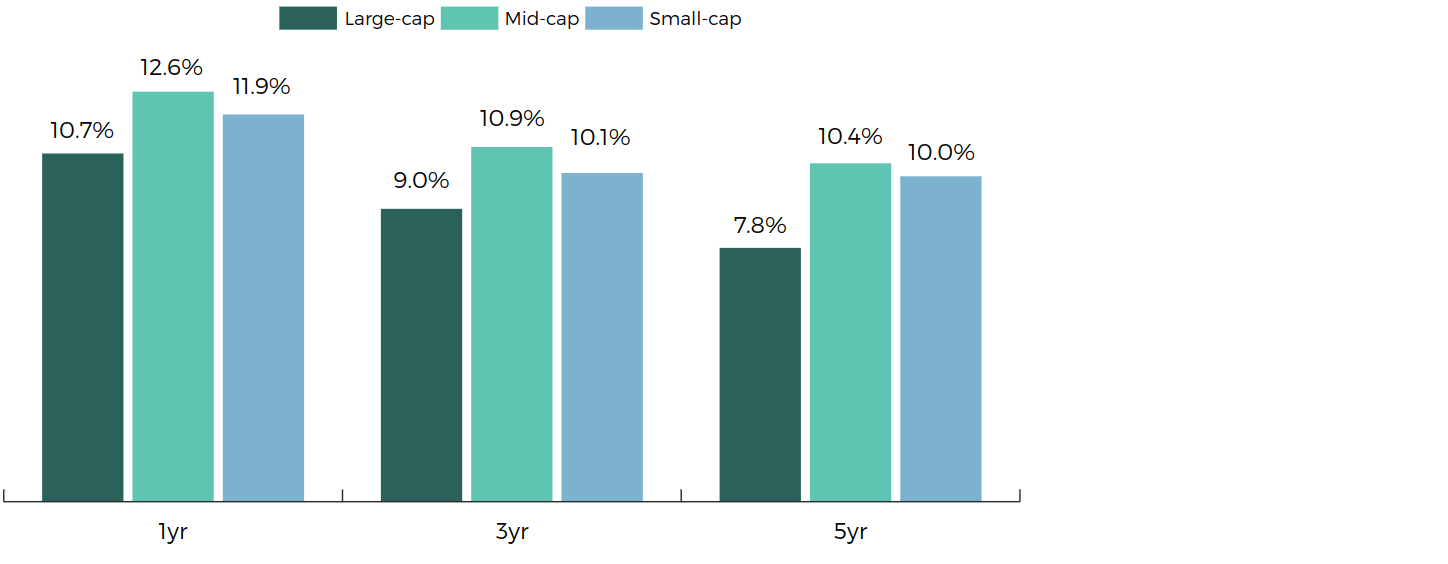

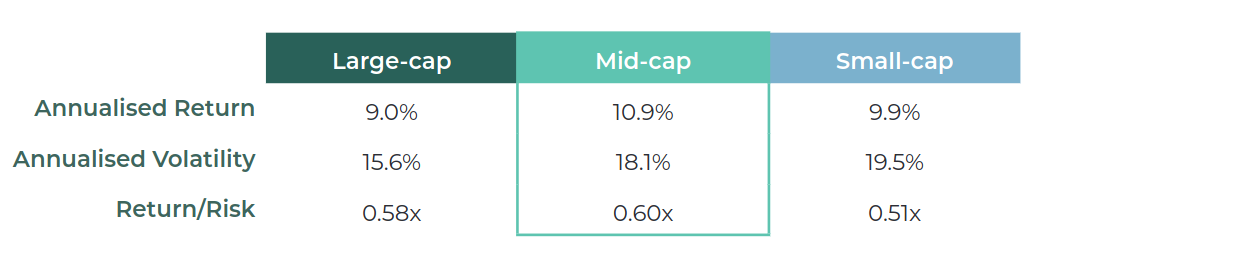

There are many reasons we believe mid-caps to be an attractive investment proposition, but generally the factor most important to investors is return on investment. Despite popular belief, mid-caps have in fact outperformed their small and large-cap counterparts not only over the longer term but also over the average rolling 1, 3, and5-year periods since 1996.

Average rolling holding period total return

For the purposes of back-testing, we use the S&P 500, S&P 400 and S&P 800 due to their long performance histories.

What’s more, the mid-cap index has outperformed with a better risk-adjusted return – so it’s not merely a case of being rewarded for taking on higher risk.

For the purposes of back-testing, we use the S&P 500, S&P 400 and S&P 800 due to their long performance histories.

Thinking about why this might be, there are three strong arguments: mid-cap stocks are under-researched and under-utilised by investors, creating more ‘alpha’ opportunities;mid-caps have grown revenues faster thansmall and large-cap counterparts; andmid-cap stocks tend to be the targets ofacquisitions by larger competitors looking toexpand or solidify their market position.

1. UNDER-RESEARCHED:

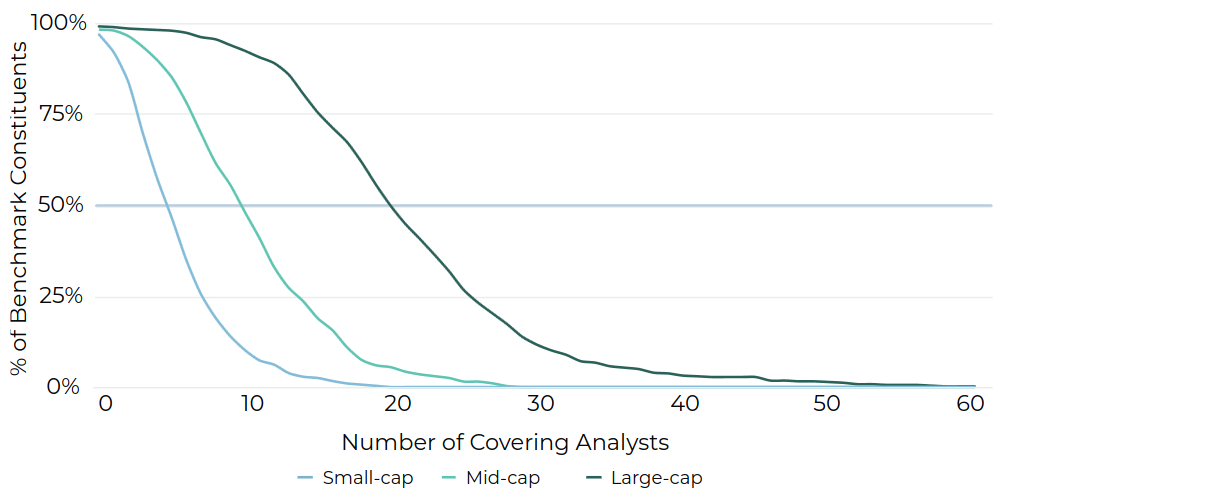

Research analysts and investment banks focus primarily on large-cap stocks – and for good reason, with large-caps representing the majority of global market capitalisation. In fact, 50% of the S&P 500 is covered by at least 21 analysts, while mid-caps are only covered by 10, and small-caps by 5. Consequently, the lack of coverage as you move down the market cap spectrum opens up investment opportunities as you could reasonably assume stock valuations are less likely to price in all available information.

% of benchmark covered by varying number of analysts

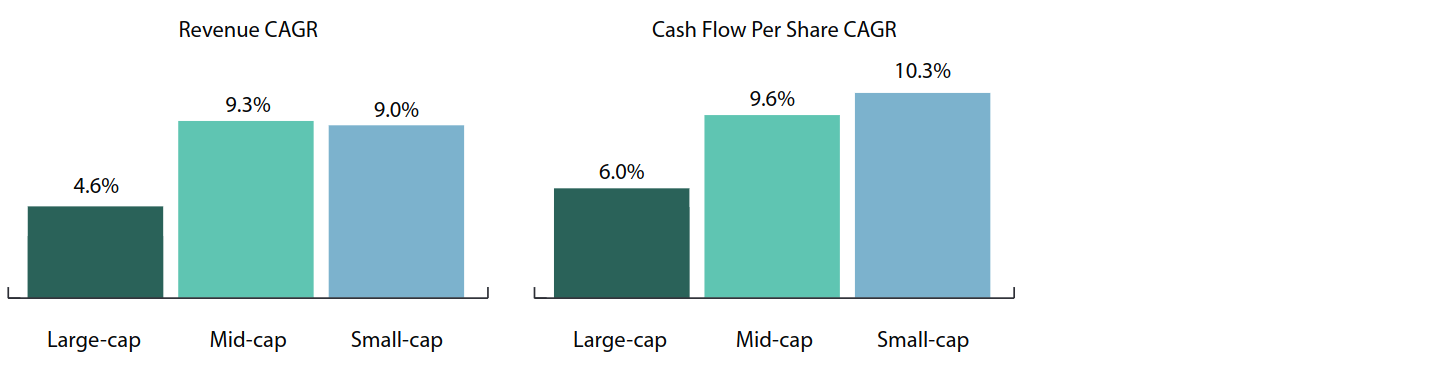

2. FASTER GROWTH:

Fundamentally, the price of stocks should reflect growth in economic value. Below we see that mid-caps have grown their revenues faster than both small and large-caps but have also grown their cash flows almost as fast as small-caps (and significantly faster than large-caps).

For the purposes of back-testing, we use the S&P 500, S&P 400 and S&P 800 due to their long performance histories.

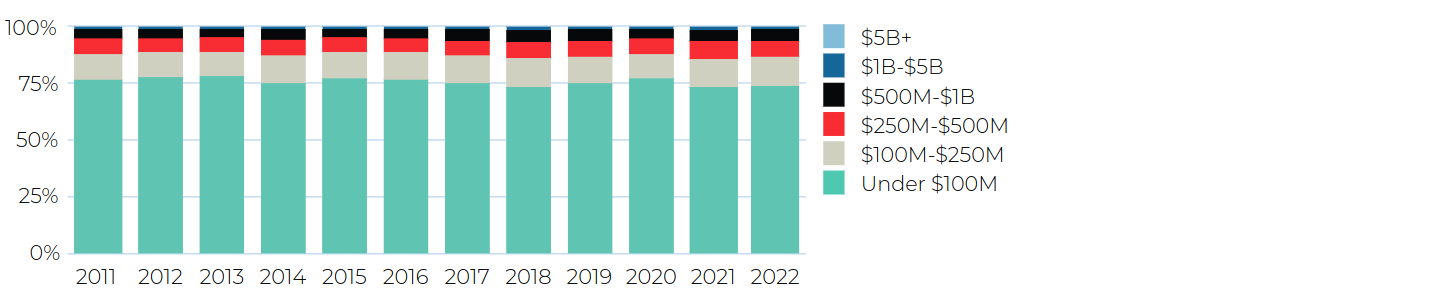

3. ACQUISITION TARGET:

Finally, another driver of mid-cap returns is that they are more likely to be acquired compared to large-caps. Mid-caps may hold leading positions in niche markets which larger businesses may seek to acquire in order to consolidate their market share or push into a new vertical. As the chart shows, the vast majority of M&A takes place well below the $5bn-plus level of the most widely publicised deals.

BUT AREN’T THEY HIGH-RISK?

A common misconception of mid-caps is that they are too illiquid or too ‘high risk’. But this is not necessarily the case. Inevitably, they are more illiquid than their large-cap counterparts but that by no means makes them illiquid. If you define risk as volatility, then they will tend to be ‘higher risk’ than their large-cap counterparts, but as we have seen previously, mid-caps have returned a disproportionately higher return relative to their volatility since 1996. Finally, if you take ‘risk’ to be the permanent loss of capital, then these fears should be eased when it is considered that these are not start-ups but multi-billion-dollar companies, often specialists in niche markets, looking to take their next step in market expansion.

M&A count by size

MID-CAPS: A SWEET SPOT FOR INVESTORS

In summary, we believe mid-caps offer investors a chance to invest in tomorrow’s leaders that have been shown to outperform their small and large-cap counterparts with better risk-adjusted returns. An often-overlooked area of the market, mid-cap stocks offer a sought-after trade-off, having outgrown their high-risk smaller stage and being able to focus on profitable growth and business expansion. For these reasons, we focus on mid-cap businesses and believe they should be a core part of investors’ portfolios.

ARE MID-CAPS SUITABLE FOR SUSTAINABLE INVESTING?

WHAT IS SUSTAINABLE INVESTING?

We define the Guinness Global Quality Mid Cap Fund as a ‘Sustainable’ fund – a strategy in which we prioritise the identification of companies whose products and services have a positive environmental or social effect and whose ESG practices are good or improving. We do not target a specific environmental or social objective at the Fund level. However, we do target businesses that individually contribute to their own, possibly overlapping, environmental or social outcomes.

CAN YOU INVEST IN SUSTAINABILITY WITHIN THE MID-CAP SPACE?

We believe so, and that the natural characteristics of mid-cap businesses make them strong candidates for the types of investments required in a sustainable Fund. We view sustainability through two lenses – the products and services of a business and what positive environment and social effects they have on the world, and the operational practices of a business from an environmental, social, and governance perspective. We examine these here.

PRODUCTS AND SERVICES

By function of their size, mid-caps tend to have fewer reporting segments or business lines than their large-cap counterparts and tend to be more pure-play in their products. Seeking mid-cap businesses in sustainability areas thus leads us to businesses with greater intentionality and materiality within those areas. Such businesses tend to have products and strategies centred around one issue (in this case a sustainability issue), as opposed to conglomerates with multiple reporting segments, separate strategies for each underlying business segment, and generally a lower degree of intentionality.

PRACTICES

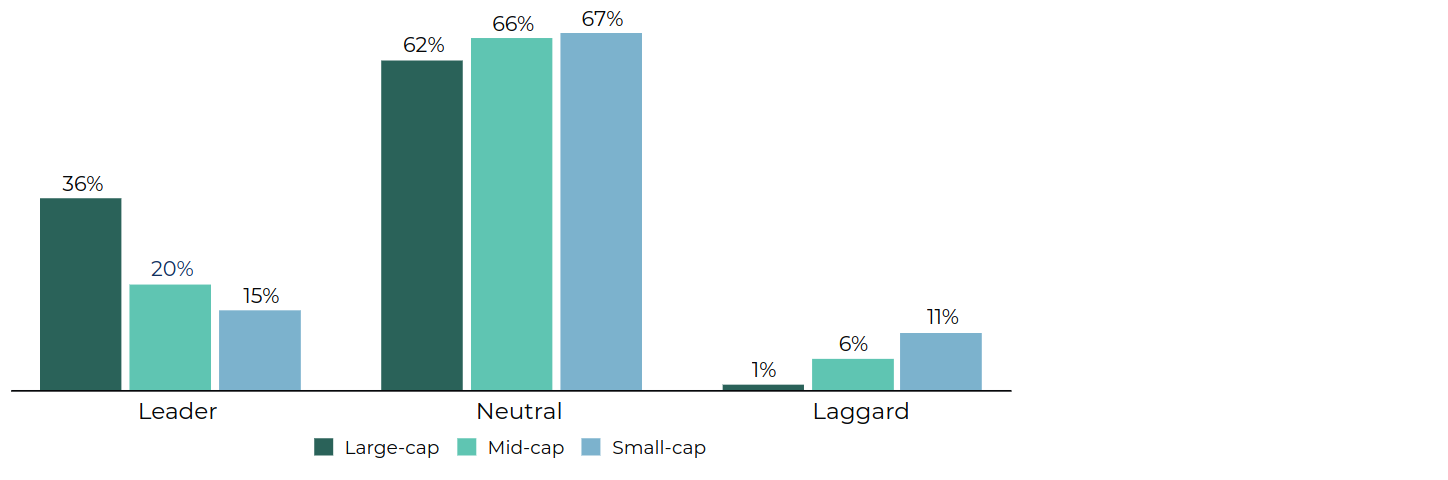

Companies are generally rewarded for improvement – be it in their sales growth, margins, or subsequent cash flow generation. In a similar vein, if a business is able to improve its operations from an ESG perspective, that may be reflected in improving fundamentals but also investor flows as they seek a portfolio of more highly rated businesses. Hence, whilst mid-caps are generally rated lower than large-caps from an ESG perspective (fewer ‘leaders’ and more ‘laggards’), either due to lack of research or the increasing ESG disclosure burden companies face, there is a greater runway for improvement.

Index breakdown by MSCI ESG rating

‘Leader’ refers to companies with MSCI ESG ratings AAA or AA, ‘Neutral’ refers to A, BBB or BB, and ‘Laggard’ B or CCC.

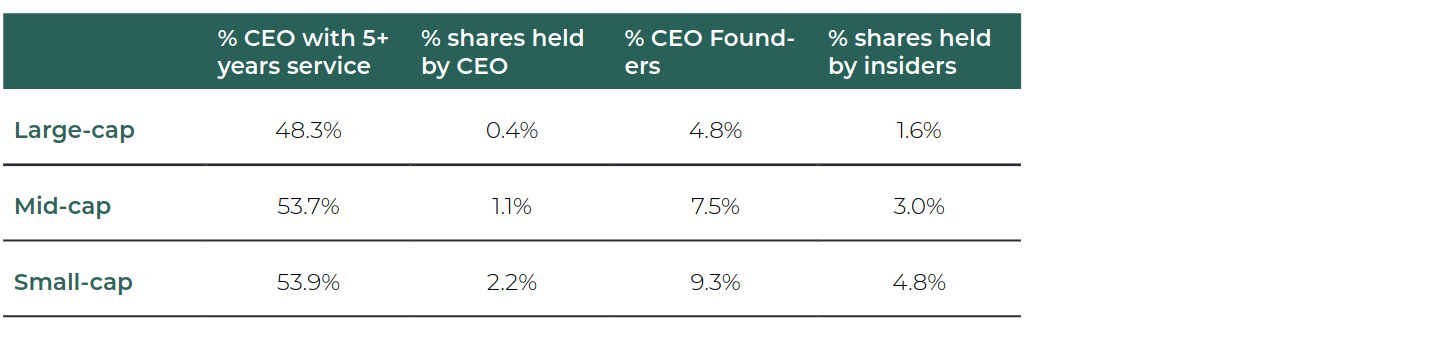

A more subtle point, and one which reverts back to mid-cap businesses’ greater degree of intentionality, is the higher proportion of management alignment. Indeed, the table shows that mid-cap businesses tend to have CEOs with longer tenures and who own a higher proportion of equity in the business. From a governance perspective, whilst founder-led businesses or entrenched management can pose their own risks, we think this lends itself to a greater alignment with the company’s long-term strategy.

OVERCROWDING IN THE LARGE-CAP SPACE

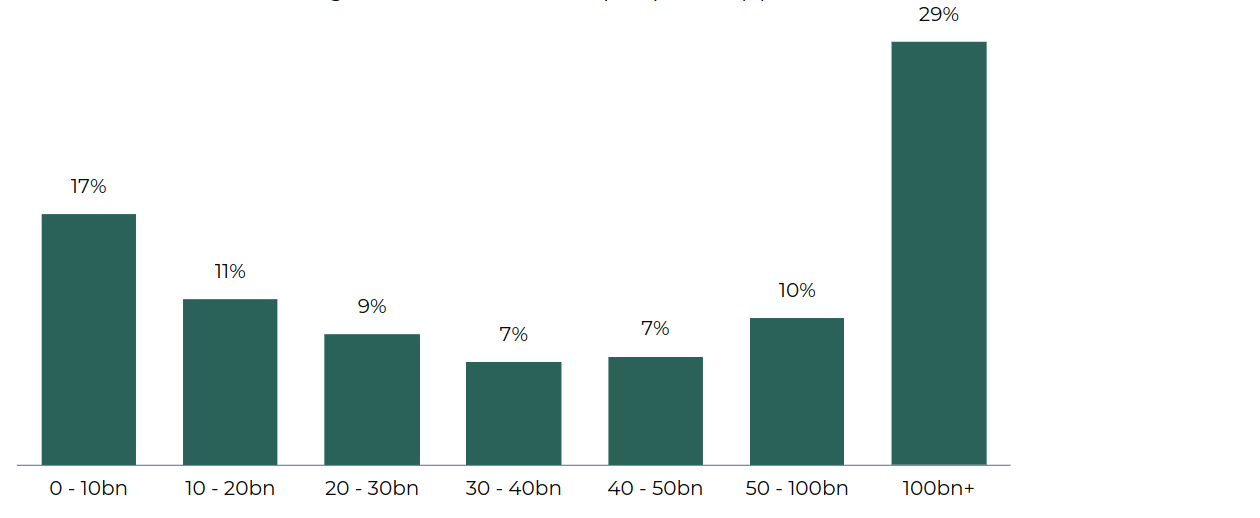

Despite the advantages we’ve outlined of investing in the mid-cap space, when we look more closely at ESG investing – from using ESG as a risk management tool, to impact investing – we find that ESG Funds tend to invest heavily in the large-cap space, and particularly the $100bn+ portion.

Average ESG Fund Market Cap Exposure ($)

A custom universe offunds created by screening the IA Global Sector for all Responsible, Sustainable and Impact funds which have similar investment policies and risk profiles to the Guinness Global Quality Mid Cap Fund.

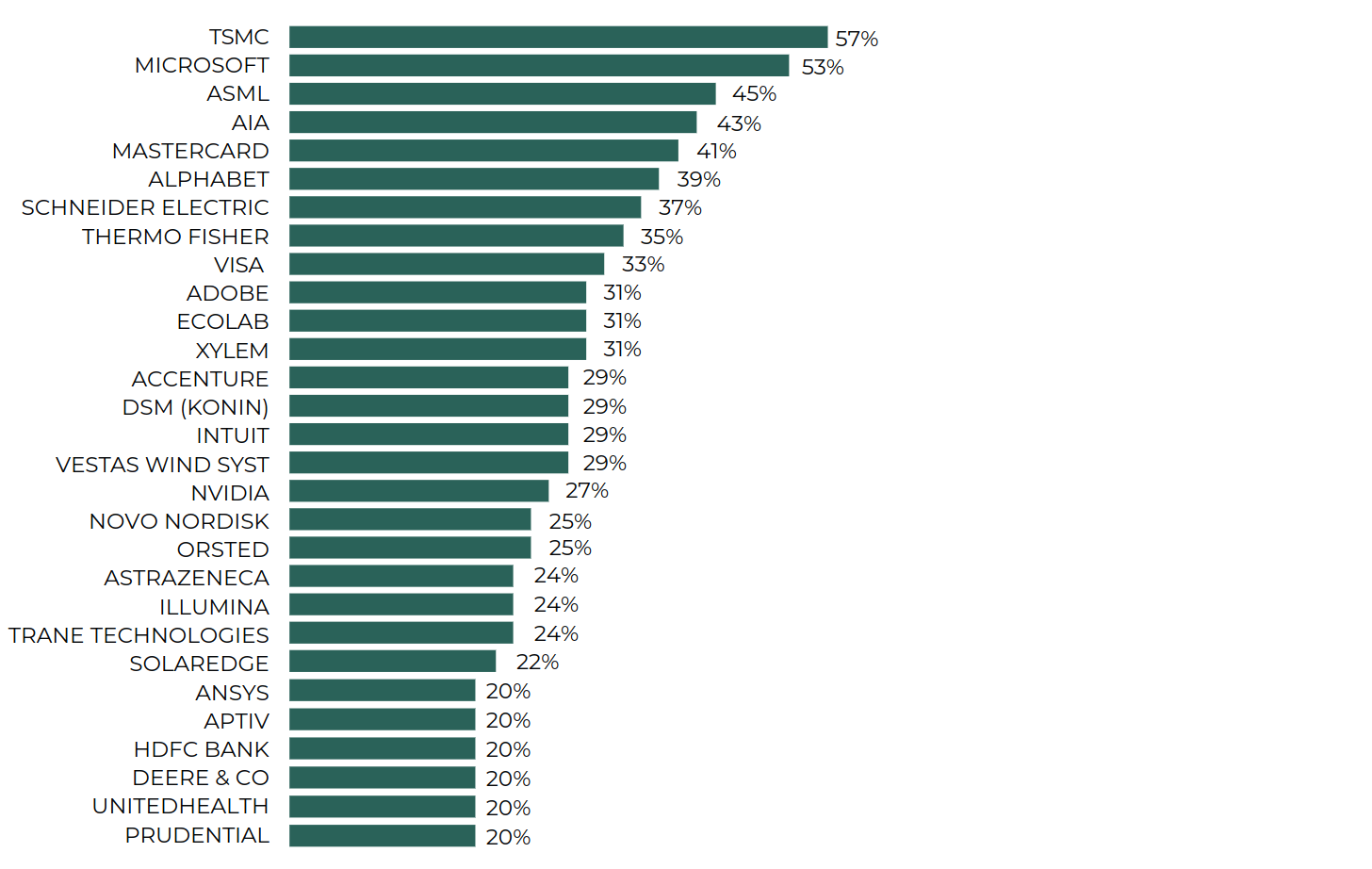

What’s more, ESG funds have a tendency to invest in the same large-cap stocks. The chart below shows the proportion of ESG funds that invest in each stock (displaying only those within 20% or more funds). Notably, we see that over half of the ESG funds in the Investment Association Global Equity sector invest in TSMC and Microsoft.

% ESG Funds held in

A custom universe of funds created by screening the IA Global Sector for all Responsible, Sustainable and Impact funds which have similar investment policies and risk profiles to the Guinness Global Quality Mid Cap Fund. Reference to specific securities is for illustrative purposes only

Thus, we believe the mid-cap space is not only desirable from a fundamental perspective, but also attractive for the differentiation it offers. Investors may find that their ESG funds are not only heavily invested in businesses with lower ESG intentionality but are also doubling up on many large-cap stocks held in non-ESG fund allocations.

Disclaimer: This Insight may provide information about Fund portfolios, including recent activity and performance and may contains facts relating to equity markets and our own interpretation. Any investment decision should take account of the subjectivity of the comments contained in the report. This Insight is provided for information only and all the information contained in it is believed to be reliable but may be inaccurate or incomplete; any opinions stated are honestly held at the time of writing but are not guaranteed. The contents of this Insight should not therefore be relied upon. It should not be taken as a recommendation to make an investment in the Funds or to buy or sell individual securities, nor does it constitute an offer for sale.

The S&P 400 index, the mid-cap index beneath the better-known S&P 500index, tries to capture stocks within the85th-93rd percentile of all available US stocks.

The constituents of the MSCI World Mid Cap Index range between $1.5bn and$38bn at time of writing.

An often-overlooked area of the market, mid-cap stocks offer a sought-after trade-off, having outgrown their high-risk smaller stage and being able to focus on profitable growth and business expansion.

For these reasons, we focus on mid-cap businesses and believe they should be a core part of investors’ portfolios.